In-kind donations are gifts of goods or services. Many nonprofits receive various forms of in-kind donations throughout the year. In fact, according to one donor loyalty study, 56% of donors prefer to donate goods and services.

Unfortunately, tracking and managing in-kind donations is not as straightforward as cash donations. This article will cover everything you need to know about in-kind donations.

What are In-Kind Donations?

In-kind donations are non-financial gifts made to an organization. In-kind donations are generally those of goods, a direct payment for a bill, or services. For example, if you are an animal shelter a gift of unopened dog food would be an in-kind donation of goods. If a donor pays directly for a vet bill that would count as a direct payment of a bill. If a veterinarian offers free services to the animals that would be an in-kind donation of services.

What are the Benefits of In-Kind Donations?

As mentioned before, 56% of donors prefer to donate goods and services. By accepting in-kind donations you create more opportunities for people to donate to your cause. Some people are limited in cash but have professional skills or supplies at their disposal to donate.

Also, if you are a non-profit that regularly has to purchase supplies, in-kind donations will save you the time of ordering and recording your purchase as an expense in your accounting software. In-kind donations can take out a step and save you and your organization time.

How do In-Kind Donations of Services Differ from Volunteering?

Generally, an in-kind donation of a service needs to be performed by a professional with a specialized skill in the service. For example, legal services, accounting services, or web design would all count as in-kind donations of services. However, a person collecting tickets at an event or performing any unskilled labor would count as volunteering.

It is important to recognize the difference between the two because in-kind donations of professional services should be recorded on an organization’s financial statements. However, volunteering does not need to be recorded as such.

In addition, in-kind donations of services can be complicated to track for tax purposes. For example, donated time (volunteering) is not tax-deductible, but if the volunteer provided goods to help complete the volunteer job, those things would be tax-deductible. To illustrate this, think about a vet providing his services to the animal shelter, their time would not be tax deductible, however, the medical supplies they used would be.

Should Your Nonprofit Accept Every In-Kind Donation?

Your nonprofit should only accept in-kind donations that you need. While many in-kind donations can benefit your organization, some are not worth your nonprofit’s time. It is important for your nonprofit to create an in-kind gift acceptance policy to avoid unwanted gifts. Creating a policy will help your staff graciously accept gifts that will benefit you while giving them a way to kindly deny other gifts.

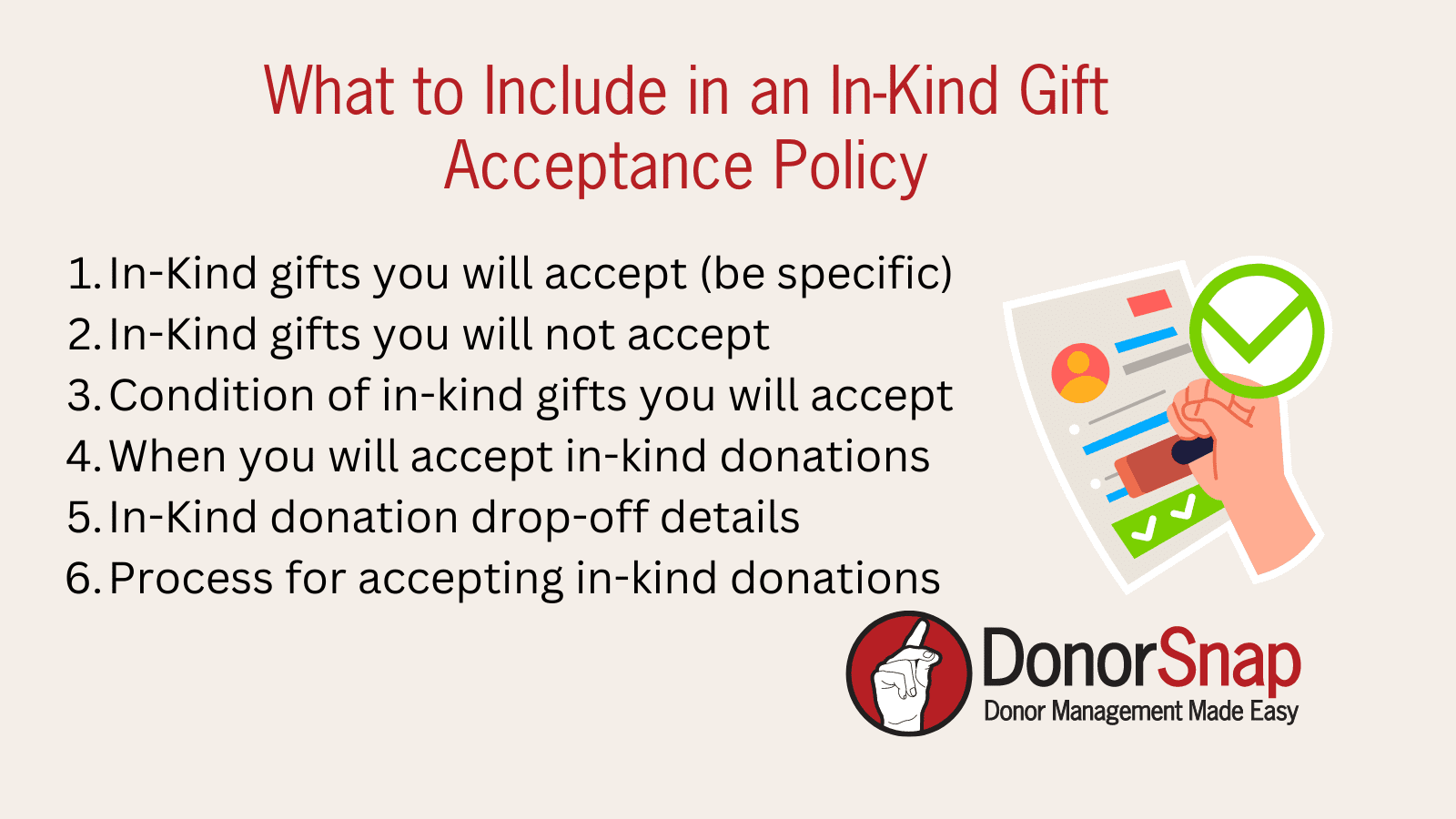

What to Include in an In-Kind Gift Acceptance Policy

1. In-Kind Gifts You Will Accept (Be Specific)

Start by brainstorming a list of supplies your nonprofit regularly needs to help create your gift acceptance policy. For example, if you are an arts organization you will likely accept in-kind donations of art supplies. If you regularly offer painting classes and know you use a ton of canvases, outline that in the policy.

Don’t forget to think about in-kind donations of services. If you are regularly looking for a professional service, highlight this in your gift acceptance policy.

2. In-Kind Gifts You Will Not Accept

It is also important to outline what gifts your nonprofit will not accept. This will prevent the waste of goods you can’t use and also prevent time lost processing gifts you can’t use. Continuing with the arts organization example, if you do not do any programs with oil paints, explicitly outline you do not accept oil paints.

3. Condition of In-Kind Gifts You Will Accept

Some nonprofits will accept gently used in-kind gifts, while others will not. Be specific in your in-kind gift acceptance policy on the condition of the items you will accept. For example, if you only will accept new unopened paint, highlight that in the policy.

4. When You Will Accept In-Kind Donations

Some nonprofits will accept in-kind donations all year round while others will have annual drives to collect items they need. It is important to let donors know when you will accept in-kind donations. This will help keep your internal operations organized and running smoothly.

5. In-Kind Donation Drop-Off Details

Most donors will drop off in-kind gifts at your location. Because it is not as simple as mailing a check or filling out an online form, highlight the details of dropping off the gift. For example, you might accept in-kind donations on Tuesdays/Thursdays and they must be dropped off at the back door of your office building.

6. Process for accepting In-Kind donations

Your nonprofit should also highlight the process for accepting in-kind donations. Some organizations will have donors fill out a form with details of the gift. There will then be an approval process before the gift is accepted. Let the donor know what to expect in terms of your in-kind donation acceptance process.

Write up your gift acceptance policy and post it on your website. Make it clearly accessible from your donation page so donors can easily find it.

How to Thank Donors for In-Kind Donations

It is best practice to thank donors for every gift that comes through your door. You should create a separate template for thanking donors for in-kind donations. These letters should include the type of gift when you received it, and if any goods or services were exchanged for the gift. Include all in-kind donations in your standard acknowledgment process with the customized letter. Hint: you can easily set this up as its own batch code in DonorSnap.

How do you Determine the Value of In-Kind Donations?

It is the donor’s responsibility to determine the value of their in-kind donation on their taxes with their tax professional. Your donor acknowledgment letter does not need to include a dollar amount of the gift. All you need to include are details of what the in-kind donation was and if any goods or services were exchanged for the gift. The rest is up to the donor to report on their taxes.

How to Track In-Kind Donations

Keeping accurate records of your in-kind donations will help you seamlessly create thank-you letters. It will also provide you with accurate reporting and financial statements.

Every nonprofit is different and it is up to you and your accountant to determine the best way to track in-kind donations. When tracking in-kind donations in DonorSnap we suggest you choose ‘in-kind’ from the donation type drop-down and do not assign a dollar amount in the amount field. You can then include what the donation is in the comments field.

If your nonprofit receives many in-kind donations you can set up custom user-defined fields to track more details. Some nonprofits create custom fields such as In-Kind Donation Value, and In-Kind Donation Description. While it is suggested not to track the value of in-kind gifts, some nonprofits do and it is easier to keep them in their own fields separate from your cash revenue.

Final Thoughts

In-Kind donations are non-monetary gifts made to an organization. This can include gifts of goods or services. In-kind donations benefit organizations in many ways, from providing more opportunities for donors to give, to receiving specialized services for free.

In-kind donations of services differ from volunteering in that they should be performed by a professional in their field. For example, legal or accounting services would be recorded as in-kind donations of time.

It is important to create an in-kind gift acceptance policy to prevent any unwanted gifts to your organization. It will also help donors know what and how to make an in-kind donation to your organization.

Dedicated donor software like DonorSnap will help you easily track in-kind donations and acknowledge them properly.