It’s the time of year where nonprofits are busy preparing their year-end tax statements. Year-end tax statements, tax letters, or contribution statements as we call them here at DonorSnap are a great way to help your donors prepare their tax returns.

What are Contribution Statements?

Contribution Statements go by a number of different names depending on your organization. They are also referred to as year-end tax statements, year-end tax receipts, giving summary, annual receipt, or end of year statements. Regardless of what you call them, they all serve the same purpose. Contribution statements are a summary of giving for the year that your donors use when writing off charitable contributions on their tax returns.

Why are Year-End Tax Statements Important?

The IRS requires that 501c3 nonprofits provide written acknowledgment to any gift over $250 dollars. However, it is best practice to acknowledge every gift to your organization. In addition to the IRS requirements, providing a cumulative statement at the end of the year has a few benefits to both the donor and the nonprofit.

According to a survey from nonprofit pro, donors appreciate getting year-end tax letters because it helps them prepare their taxes. In addition, when they see the totality of their giving they are often pleasantly surprised and feel good about what they have contributed. Contribution statements can be specifically beneficial to monthly donors, or donors who gave more than once over the course of a year.

Creative Ideas to Make Your Contribution Statements Pop

There are a number of ways nonprofits can use design elements to make their year-end tax statements stand out and effectively engage their donors. Below, find 7 creative ideas to use in your nonprofit year-end tax statements.

1. Align your end of year tax letters with your branding

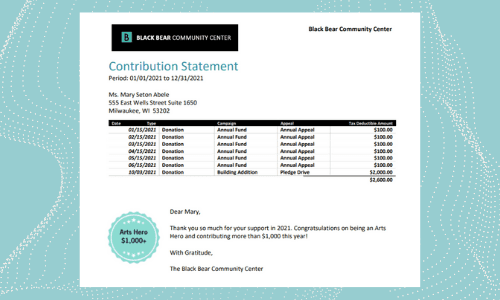

Every piece of communication your nonprofit sends out is a reflection of your brand. When your nonprofit has a strong brand it will be easily recognizable, it will improve credibility and trust, and ultimately result in more support. According to Nonprofit Pro, branding at its essence is about creating the relationship you want to have with your audience to foster preference, loyalty and trust.

Think about how you can incorporate your brand into your year-end contribution statements. The most basic elements of your brand should be considered to start. For example, think about your font, colors, and logo. All of these elements can be adjusted in DonorSnap’s custom contribution statements.

Download our Simple Contribution Statement Template

Download our Sophisticated Contribution Statement Template

2. Add a thank you to your year-end tax statements

The IRS requires that you include the following on your tax statements:

- Name of the organization;

- Amount of cash contribution;

- Description (but not value) of non-cash contribution;

- Statement that no goods or services were provided by the organization, if that is the case;

- Description and good faith estimate of the value of goods or services, if any, that organization provided in return for the contribution; and

- Statement that goods or services, if any, that the organization provided in return for the contribution consisted entirely of intangible religious benefits, if that was the case.

However, you should never miss an opportunity to thank your donors. Including a thank you note on your year-end tax statements is a great way to summarize how their giving helped support your organization. It can be shorter than the regular acknowledgment letters you send out immediately after donation. A short and impactful thank you at the top or bottom of your contribution statement is a great addition to any year-end tax letter.

Download our Contribution Statement Template with Thank You Letter

3. Add visuals to your contribution statements

The addition of visuals can help highlight important elements in your year-end tax letters. One way to highlight a donor’s total giving is to include a badge with a merge field for the total giving for the year. When printed out, their total will display on a golden badge and will stand out in the letter.

Download our Contribution Statement with Gold Badge

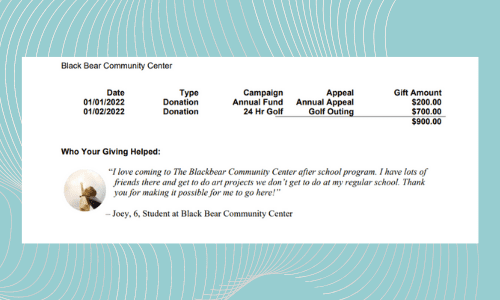

4. Easily display giving using tables on your year-end tax letters

You will see tables on most year-end tax statements. They are especially helpful when the donor has given multiple gifts, so you can display the sum of their giving in an easy-to-read format. When formatting your tables, think about the overall look and feel of your letter. If it is in line with your branding it will already have a certain look with your font and coloring.

There are a number of table options from dark and bold to soft and light. Choose a table design that reflects well with the vibe of your organization. For example, if you are an organization that supports children, your branding will likely be fun, playful, and creative. So choose a table with bold colors and fonts.

5. Consider adding a QR code to your contribution statement with a link to a video

In DonorSnap you can both print and email a PDF version of your contribution statements. If you are emailing a PDF you can simply include a link to any media you wish. If you are using a print version, consider using a QR code so donors can watch a video on their phones. Your video could be a year-end summary with everything your nonprofit has accomplished, a thank you message from someone you serve, or a message of thanks from your Executive Director.

Adding a QR code to your contribution statement is simple. There are many free QR code generators available online. Simply paste in your link and get your QR code image. Then all you have to do is place the QR code in your statement as an image.

6. Include testimonials on your tax statements

If your nonprofit serves people, consider adding a testimonial from someone in the population you serve. Showing the impact of a gift helps reassure your donors that their donation dollars are going to good use. Highlighting how their gift helped an individual will have a profound impact on your supporters.

Download our Contribution Statement Template with Testimonial

7. Leverage segmentation for your end of year tax letters

A good nonprofit CRM will allow you to segment your mailing lists. Segmentation can be beneficial even with something as simple as year-end tax statements. You might have a standard template you use, but perhaps you want to provide something a little more for people who donated over a certain amount or who contributed to a specific cause.

For example, you might create mailing lists based on giving levels and then create a few different year-end tax letters with notes specific to those giving categories. Perhaps someone well known in your organization passed away and you received a handful of memorial donations to them in a specific year. Include a note on that segmented template about the person and how much was raised collectively.

Final Thoughts

Acknowledging donations of $250 or more to your nonprofit is required by the IRS. However, it is best practice for your nonprofit to acknowledge every donation received. In addition, providing a year-end tax statement to your donors is beneficial because it will help them prepare their taxes and will also have a positive impact on how they feel about their giving over the year.

Year-end tax statements are often standard reports with no real stylizing done to them. However, every piece of communication your nonprofit sends out is an opportunity to connect with and engage your audience. There are a number of ways nonprofits can get creative with their year-end tax contribution statements. This includes thinking about branding, saying thank you, using visuals, adding tables, and including QR codes or testimonials.